This week, Decision Science News’ Dan Goldstein travels to Boulder, and we team up for a joint post (over grilled steak). — Enjoy

Most people are happy to have a few types of insurance coverage, typically home, health, and life insurance. However, you can insure most anything. A few of the more peculiar insurance products that recently caught our eye (from here and here):

– Backpacking insurance. In case you get sick or have your backpacking trip canceled.

– Kidnap and ransom insurance. In case you get kidnapped and held for ransom (duh).

– Your hands. If you are a yo-yo champion.

– Your derriere. If you are Jennifer Lopez.

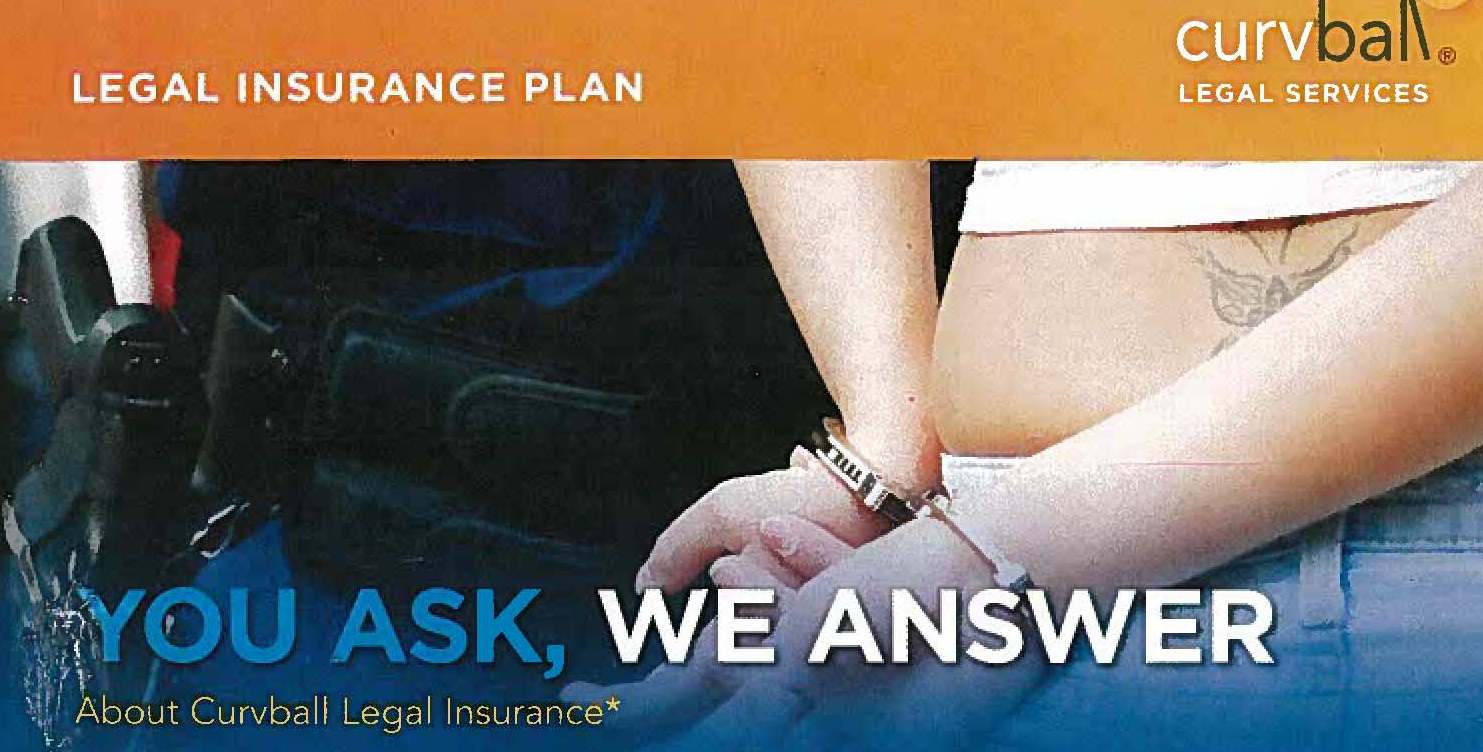

And Pete’s favorite: Legal insurance, which was being advertised in the local college student magazine:

Being a Curvball member means you can speak to a criminal defense lawyer immediately. Get the information and advice you need. Don’t wait to be intimidated by a law enforcement officer with an agenda, or an aggressor looking for someone to blame. You can have a lawyer on the phone in 60 seconds.

People like us (the type who would read this blog) probably have health, and if they have a home, homeowners insurance. At the same time, people like us laugh at the idea of buying extended warranties from the big box electronics stores. The question we pose: Where do we draw the line?

Take car insurance, for example. Pete has a car and has no collision insurance on it (he, of course, has liability insurance for it), whereas Dan, when he had a car, bought collision insurance because that what his family always did.

Who is right, and if you have a car, what do you do?